Hurricane Debby Update: Navigating the Aftermath and Preparing for the Next Steps

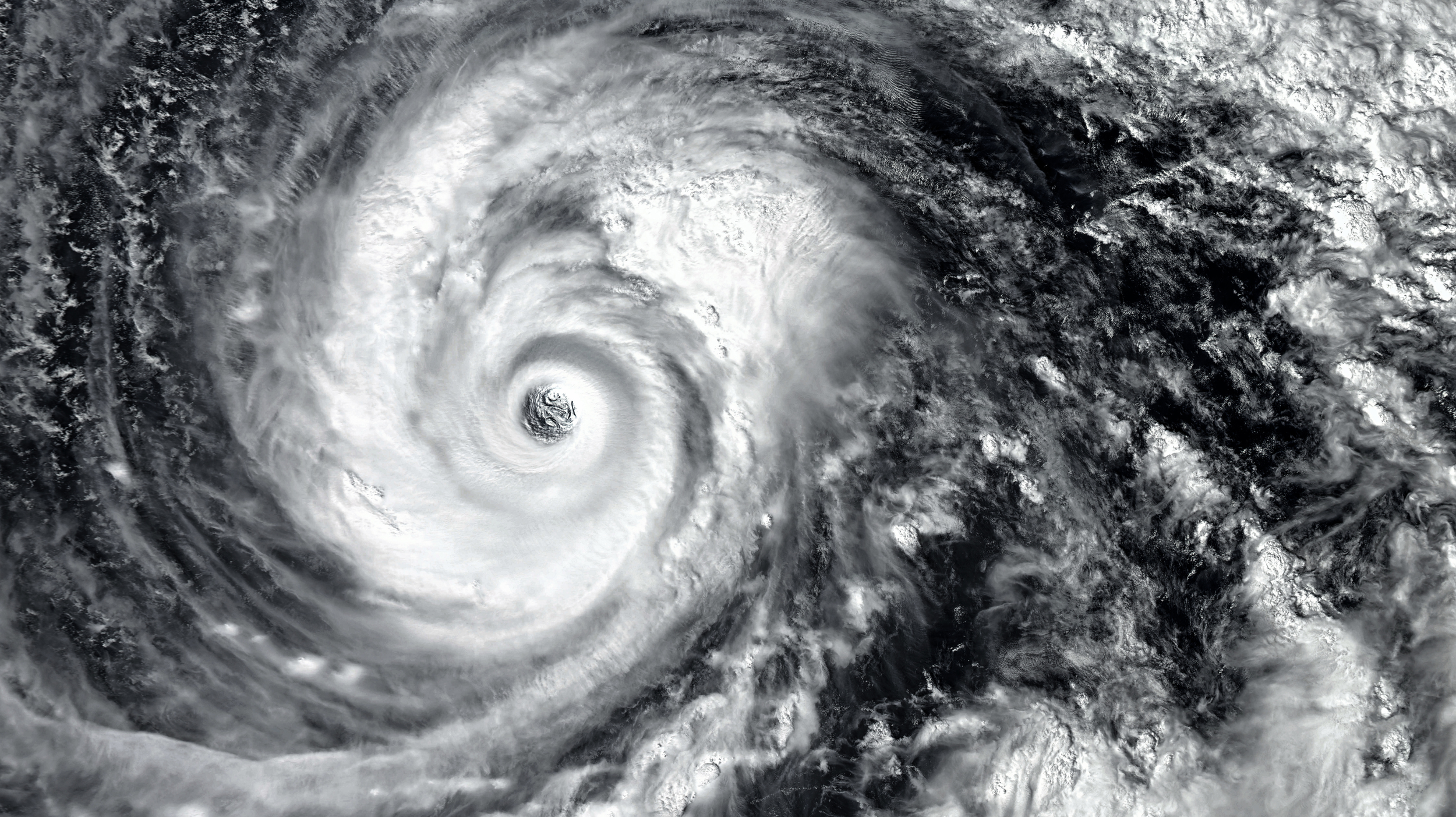

On Monday, August 5th, Hurricane Debby made landfall in Steinhatchee, Florida, as a Category 1 hurricane with maximum sustained winds of 80 mph. The storm brought heavy rain, high winds, and significant flooding to many parts of Florida, causing widespread damage and prompting numerous rescue operations.